2021 4th Quarter Earnings

Bay Community Bancorp Reports Fourth Quarter 2021 Earnings Increase 10.8% to a Record $1.75 Million; Full Year 2021 Earnings Increase 51.7% to a Record $7.41 Million; Declares Quarterly Cash Dividend of $0.04 Per Share

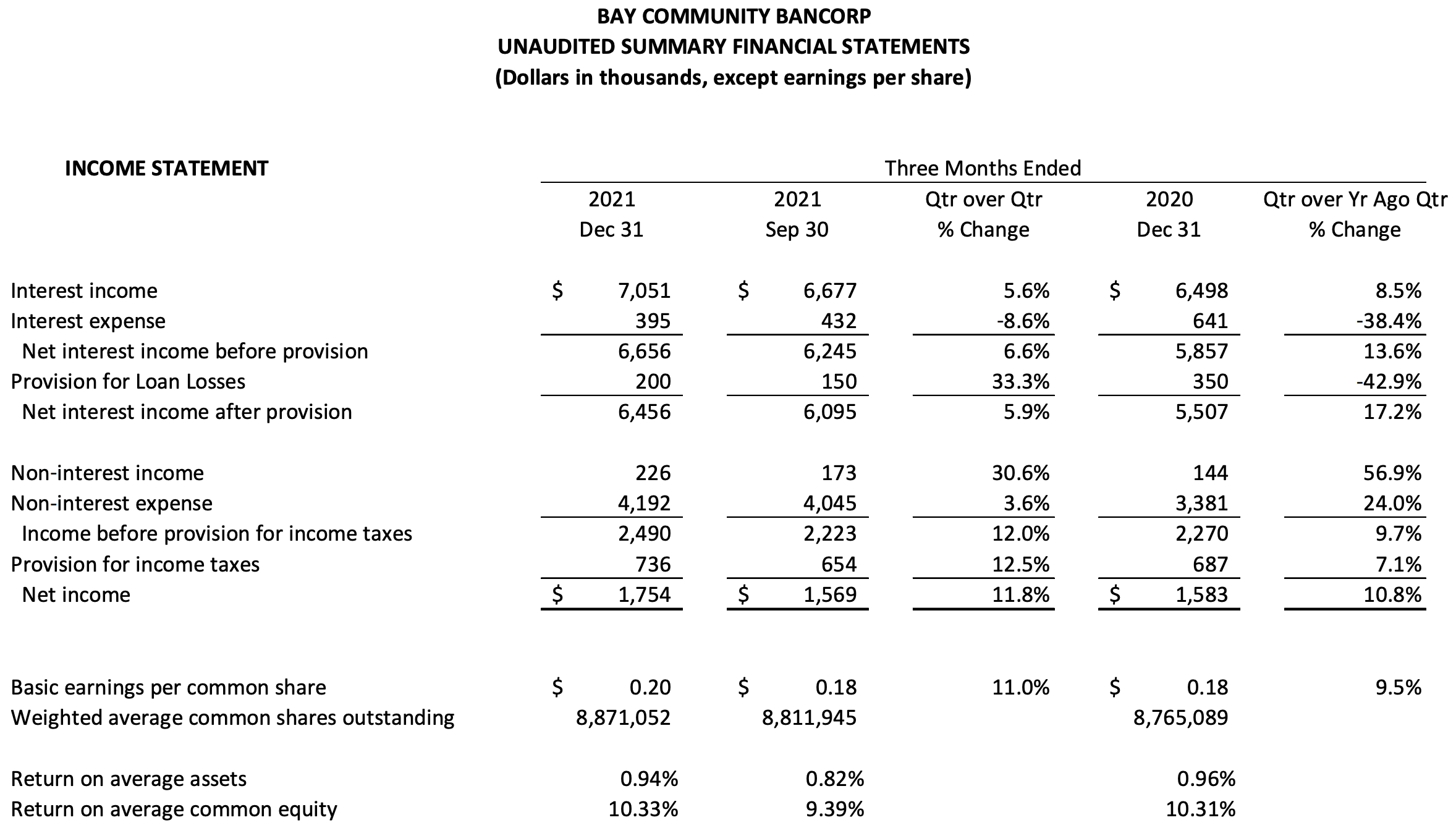

OAKLAND, CA – January 31, 2022 — Bay Community Bancorp, (OTCPink: CBOBA) (the “Company”), parent company of Community Bank of the Bay, (the “Bank”) a San Francisco Bay Area commercial bank with full-service offices in Oakland, Danville and San Mateo, today reported earnings increased 10.8% to $1.75 million for the fourth quarter of 2021, compared to $1.58 million for the fourth quarter of 2020. Strong core loan growth together with interest and fee income from the Small Business Administration’s (SBA) Paycheck Protection Program (PPP) loans contributed to profitability for the quarter. For the year 2021, net income increased 51.7% to a record $7.41 million, compared to $4.89 million in 2020. Interest and fee income from PPP loans, as well as a substantial CDFI Rapid Response Grant award during the second quarter of 2021, contributed to record profitability for the year. All financial results are unaudited.

The Company’s Board of Directors declared a quarterly cash dividend of $0.04 per share. The dividend is payable on March 4, 2022 to shareholders of record on February 23, 2022. This marks the fourth consecutive dividend payment since the Company initiated quarterly cash dividends on April 30, 2021.

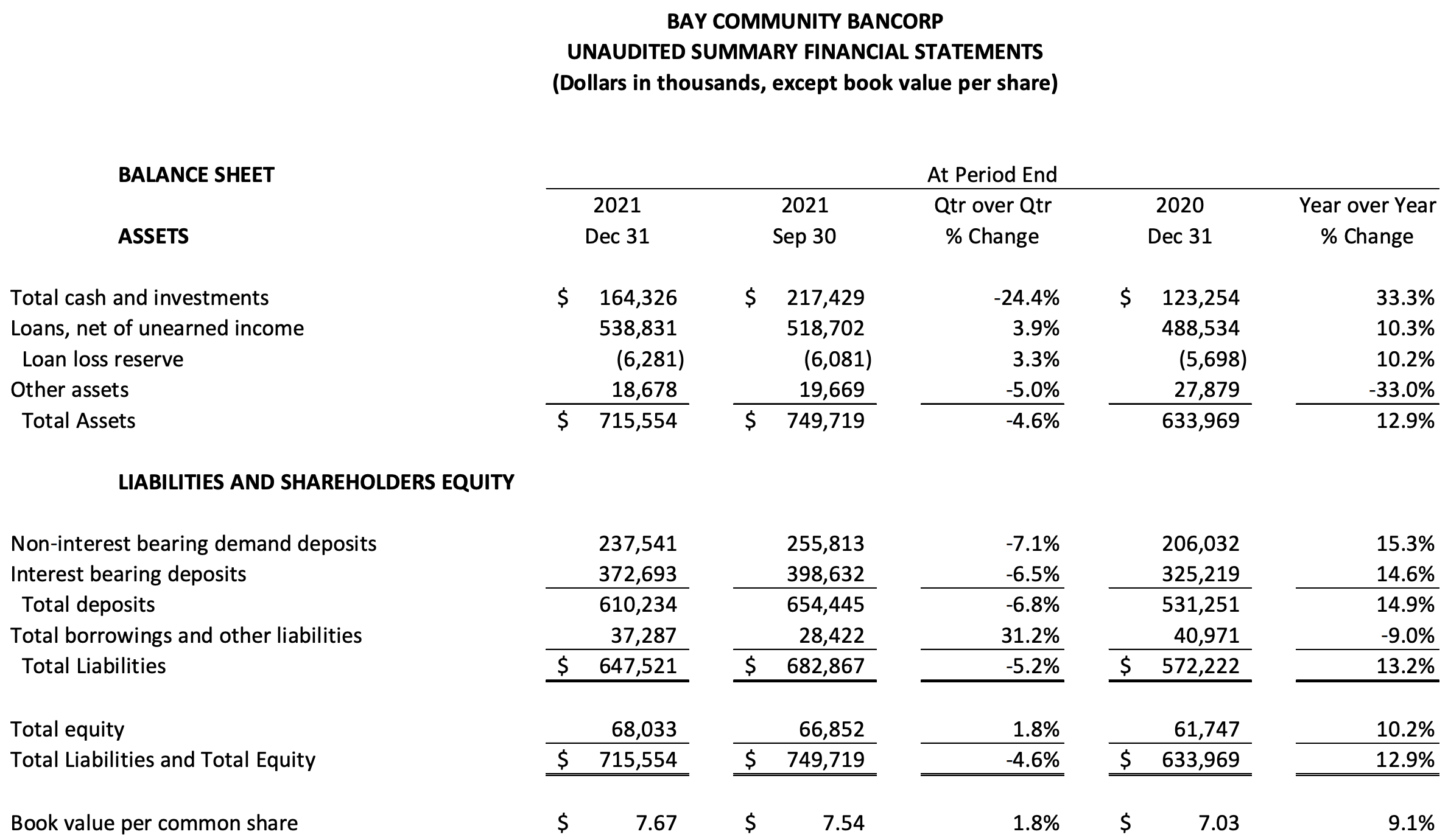

“During the fourth quarter we continued pivoting away from extraordinary pandemic-related activities and government initiatives, and shifted towards a more normalized banking structure,” stated William S. Keller, President and CEO. “Operating revenue increased during the fourth quarter compared to a year ago, driven by lower cost of funds, increased loan balances and stable non-interest-bearing deposits. Some of the pandemic induced liquidity that found its way to the nonprofit base has started to unwind, and, as a result, total deposits decreased at year end compared to the prior quarter end. However, core loan growth during the fourth quarter was substantial at $37.6 million, or 9.2%, from the linked quarter, with an uptick in commercial real estate loans. Most of the quarterly loan growth is attributed to a combination of new clients as well as new activity from existing clients, and we anticipate this will continue over the next few quarters as our loan pipeline remains strong. We will continue to focus on growing the loan portfolio and reducing liquidity levels to reach a more normalized balance sheet structure.”

“The highly successful PPP lending program sponsored by the SBA has helped thousands of businesses in our core market,” Keller continued. “We were active participants in the PPP, resulting in over $154 million in PPP loans originated over the course of the two rounds of the program. While the program’s contributions to net income and loan portfolio growth are unlikely to be repeated in future quarters, the opportunities to serve new clients and deepen relationships with existing customers positions us well for the future. We are working with our clients and prospects as they navigate the transition back to a post-pandemic economy and we were able to generate strong organic loan growth during the quarter. The success of our lending services is fueling profitability and providing new market opportunities, which is reflected in our balance sheet growth with total deposits increasing 14.9% in the past year, and net non-PPP loans growing 17.7% in that period.”

As of December 31, 2021, the Company had received payments from the SBA for forgiveness of $119.6 million for 807 PPP borrowers. At year end, the Company had a total of $38.6 million in gross PPP loans remaining on its books. Approximately $829,000 of the fee income recognized during the fourth quarter of 2021 was related to these PPP loan payoffs, compared to $575,000 of the fee income recognized during the prior quarter. Going into 2022, approximately $1,081,000 in net unrecognized fee income remains to be recognized in relation to the PPP loan portfolio, which is expected predominantly during the first half of the year.

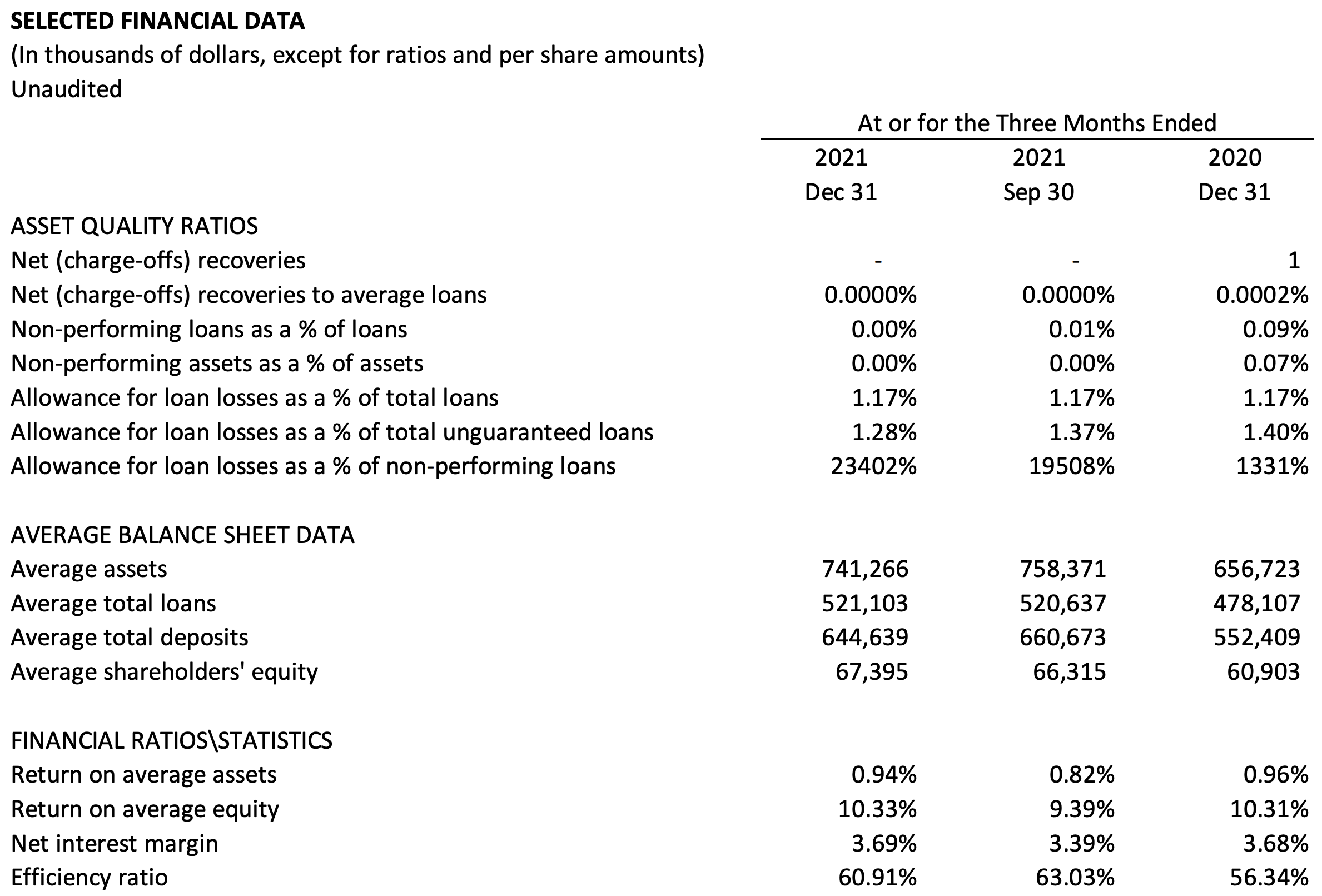

The Company’s net interest margin was 3.69% in the fourth quarter of 2021, a 30 basis point improvement compared to 3.39% in the preceding quarter, and a 1 basis point improvement compared to 3.68% in the fourth quarter a year ago. “PPP loan fees and interest on net interest income had a positive impact on net interest margin for the fourth quarter of 2021. Also helping the net interest margin for the current quarter was our lower cost of funds. However, liquidity levels have been higher than usual throughout the year, due to larger deposit balances and the resulting effect on the mix of our earning assets, together with higher excess reserves at the Fed continuing to put pressure on our net interest margin,” said Keller. PPP loan fees and interest added 50 basis points to the net interest margin for the fourth quarter of 2021, compared to adding 40 basis points in the preceding quarter. Excess reserves had a negative impact on the net interest margin for the fourth quarter of 2021, contracting the net interest margin by 75 basis points, compared to a 92 basis point decrease for the third quarter of 2021.

“During the fourth quarter of 2021, we booked a $200,000 loan loss provision in recognition of the considerable core loan growth and improving economic indicators in our market,” said Mukhtar Ali, Chief Credit Officer. “Our loan loss reserves represent 1.28% of total non-guaranteed loans at December 31, 2021, compared to 1.40% a year earlier. We continue to review our loan portfolio and communicate with our borrowers. We believe we have adequate provisions in place as we navigate through the later stages of the pandemic.” The Bank had no loans on deferral at December 31, 2021.

Fourth Quarter 2021 Financial Highlights (at or for the period ended December 31, 2021)

- Net income increased 10.8% to $1.75 million in the fourth quarter of 2021, compared to $1.58 million in the fourth quarter a year ago, and increased 11.8% compared to $1.57 million in the preceding quarter. Earnings per share was $0.20 in the fourth quarter of 2021, compared to $0.18 in the prior quarter, and $0.18 in the fourth quarter a year ago.

- Total assets increased $81.6 million, or 12.9%, to $715.6 million at December 31, 2021, compared to $634.0 million a year earlier, but decreased $34.2 million, or 4.6%, compared to $749.7 million three months earlier. Average assets for the quarter totaled $741.2 million, an increase of $84.5 million, or 12.9%, from the fourth quarter a year ago and a decrease of $17.1 million, or 2.3%, compared with the prior quarter.

- Net interest income, before the provision for loan losses, increased 13.6% to $6.66 million in the fourth quarter of 2021, compared to $5.86 million in the fourth quarter a year ago. The provision for loan losses was $200,000 in the fourth quarter of 2021, compared to $350,000 in the fourth quarter of 2020.

- Non-interest income was $226,000 during the fourth quarter of 2021, compared to $144,000 for the fourth quarter a year ago, and $173,000 in the third quarter of 2021.

- Operating revenue (net interest income before the provision for loan losses plus non-interest income) increased 7.2% to $6.88 million in the fourth quarter of 2021, compared to $6.42 million in the third quarter of 2021, and is up 14.7% compared to $6.00 million in the fourth quarter of 2020.

- Net interest margin for the fourth quarter improved to 3.69%, compared to 3.39% in the preceding quarter and 3.68% in the fourth quarter a year ago. The expansion in net interest margin in the fourth quarter of 2021 as compared to the prior quarter was largely due to the increase in recognition of PPP origination fee income due to $24.9 million in PPP loan forgiveness. Excluding all PPP-related income and balances, the net interest margin would have been 3.35% in the fourth quarter of 2021, and 3.24% in the third quarter of 2021. The average interest yield on non-PPP loans in the fourth quarter was 4.56%, compared to 4.65% in the prior quarter. The average cost of funds in the fourth quarter was 0.23%, a 2 basis points decline compared to the prior quarter and a 20 basis points decline compared to the prior year.

- Net loans increased $50.3 million, or 10.3%, to $538.8 million at December 31, 2021, compared to $488.5 million a year ago, and increased $20.1 million, or 3.9%, compared to $518.7 million three months earlier. At December 31, 2021, net non-PPP loans totaled $500.2 million, a 9.9% increase compared to $455.1 million at September 30, 2021, and an 18.4% increase compared to $422.5 million at December 31, 2020. In addition, at December 31, 2021 the unused portion of credit commitments totaled $139.4 million compared to $117.2 million in the prior quarter and $98.8 million a year ago.

- Total deposits increased $79.2 million, or 14.9%, to $610.2 million at December 31, 2021, compared to $531.3 million a year ago and decreased $44.2 million, or 6.8%, compared to $654.4 million three months earlier. The decrease compared to the prior quarter end was partially due to year end withdrawals from a few large nonprofit deposit accounts, as well as seasonal reductions in Title Company deposits. Noninterest bearing demand deposit accounts increased 15.3% compared to a year ago and represented 38.9% of total deposits. Savings, NOW and money market accounts increased 40.6% compared to a year ago and represented 48.4% of total deposits. CDs decreased 32.8% when compared to a year ago and comprised 12.7% of the total deposit portfolio, at December 31, 2021. For the quarter, the overall Cost of Deposits was 12 basis points (“bp”) compared to 13 bp in the prior quarter, and 31 bp in the fourth quarter a year ago.

- Asset quality remained exemplary with $27,000 of nonperforming loans at December 31, 2021, representing 0.005% of total loans. This compares to nonperforming loans at 0.01% of total loans at September 30, 2021, and 0.08% at December 31, 2020.

- The allowance for loan losses increased to $6.28 million, or 1.17% of total loans at December 31, 2021, compared to $5.70 million, or 1.17% of total loans at December 31, 2020. The allowance, as a percentage of non-guaranteed loans, was 1.28% at December 31, 2021, compared to 1.40% a year ago. The allowance for loan losses reflects management’s assessment of the current economic environment.

- Total equity increased 10.2% to $68.0 million as of December 31, 2021, compared to a year ago. The Bank’s capital levels remained well above FDIC “Well Capitalized” standards as of December 31, 2021, with a Tier 1 Common Equity capital ratio of 12.28%; Total risk-based capital ratio of 13.45%; and Tier 1 leverage ratio of 9.15%.

- Book value per common share totaled $7.67 as of December 31, 2021, an increase of 9.1% from a year ago.

- Declared a quarterly cash dividend of $0.04 per share. The dividend is payable March 4, 2022 to shareholders of record on February 23, 2022.

On December 14, 2021, the US Treasury announced a list of financial institution applicants approved to receive investment under the Emergency Capital Investment Program (ECIP). Established by the Consolidated Appropriations Act, 2021, the Act was signed into law on December 27, 2020 and was created to encourage low and moderate-income community financial institutions to augment their efforts to support small businesses and consumers in their communities.

Under the program, Treasury will provide up to $9 billion in capital directly to depository institutions that are certified Community Development Financial Institutions (CDFIs) or minority depository institutions (MDIs) to, among other things, provide loans, grants, and forbearance for small businesses, minority-owned businesses, and consumers, especially in low-income and underserved communities, that may be disproportionately impacted by the economic effects of the COVID-19 pandemic.

“We are very pleased to be one of only 5 California banks, and 186 financial institutions of all types nationwide to have been approved by Treasury for an investment under ECIP, and we are proud to be included among these other banks,” said Keller. “We look forward to working with Treasury to finalize their investment, and are excited by the increased services and lending opportunities that we will be able to provide to our clients and the communities we serve as a result.”

For additional information on the ECIP Program please visit

For additional information on the CDFI Rapid Response Program please visit

https://www.cdfifund.gov/programs-training/programs/rrp

About Bay Community Bancorp

Bay Community Bancorp (OTCPink: CBOBA) is the parent company of Community Bank of the Bay, a San Francisco Bay Area commercial bank with full-service offices in Oakland, Danville and San Mateo. Community Bank of the Bay serves the financial needs of closely held businesses and professional service firms, as well as their owner-operators and non-profit organizations throughout the San Francisco Bay Area. Community Bank of the Bay is a member of the FDIC, an SBA Preferred Lender, and a CDARS depository institution, headquartered in Oakland, with full-service branches in Danville and San Mateo. It is also California’s first FDIC-insured certified Community Development Financial Institution and one of only three operating in the Bay Area. The bank is recognized for establishing the Bay Area Green Fund to provide financing to sustainable businesses and projects and supports environmentally responsible values. Additional information on the bank is available online at www.BankCBB.com.

Forward-Looking Statements

This release may contain forward-looking statements, such as, among others, statements about plans, expectations and goals concerning growth and improvement. Forward-looking statements are subject to risks and uncertainties. Such risks and uncertainties may include but are not necessarily limited to fluctuations in interest rates, inflation, government regulations and general economic conditions, including the real estate market in California and other factors beyond the Bank’s control. Such risks and uncertainties could cause results for subsequent interim periods or for the entire year to differ materially from those indicated. Readers should not place undue reliance on the forward-looking statements, which reflect management’s view only as of the date hereof. The Bank does not undertake, and specifically disclaims, any obligation to update or revise any forward-looking statements, whether to reflect new information, future events, or otherwise, except as required by law.

FINANCIAL TABLES TO FOLLOW: