Our Impact

As a community bank, we’re here to help secure your financial future while doing good in the community.

Banking with a Mission

Our mission is to make a positive and sustainable economic impact on our community as a committed and resourceful financial partner to local businesses, creative professionals, and nonprofit organizations.

-

Building a Better World

Anchor Engineering and CBB are weaving diversity into the construction of our society’s infrastructure by empowering women in the industry.

-

Supporting a Greener Planet

Byrd’s Filling Station is championing a greener economy by offering a zero-waste way to grocery shop as part of CBB’s Bay Area Green Fund initiatives.

-

Making an Impact in the Community

Lao Family Community Development, Inc. is a winner of the 2023 Real Estate Deals of the Year’s Community Impact Award for their affordable housing project with financing from CBB.

Our Team

Our most important assets are our team members; they’re at the heart of our mission and the key to our success. We believe that our team’s diverse backgrounds and experiences make us a better bank. We seek employees who are as diverse as the communities we serve.

Our Clients

We serve organizations from many industries, including nonprofits, multi-generational businesses, creative professionals, and owner-operators. They all have one thing in common — they’re local.

Grounded in communities, we serve the “real economy” and enable local businesses and communities to thrive. CBB does not invest in hedge funds and other financial activities that are simply “betting” on the economy.

2022 Impact Report

We are pleased to share our 2022 Impact Report: Rooted in Community. Our impact report provides data and stories about Community Bank of the Bay’s community impact initiatives, including affordable housing, volunteerism, philanthropy, impact lending, and green initiatives.

These are stories of growth, revitalization, and more. We invite you to read more about the impact we are making throughout the entire Bay Area. Download the report here.

Our community can do great things when everyone has access to equitable opportunities.

— William S. Keller, CEO of Community Bank of the Bay

Our Philanthropy

We’re proud to sponsor local nonprofit organizations working to better our community, and we encourage our staff to participate in worthwhile community service projects. CBB offers each team member a paid day to volunteer in the community. Our employees use this day to volunteer at local socials, food banks, religious organizations, and other non-profits.

CDFIs Help People When Others Turn Them Away

As California’s first certified CDFI, we expand economic opportunities in underserved areas while making a broad spectrum of community contributions. Learn more about what it means to be a CDFI.

In 2018, we signed the Anti-Displacement Code of Conduct because stopping displacement follows our mission as a values-based bank. In fact, we’re proud to say that we’re one of the only banks in the State of California to do so.

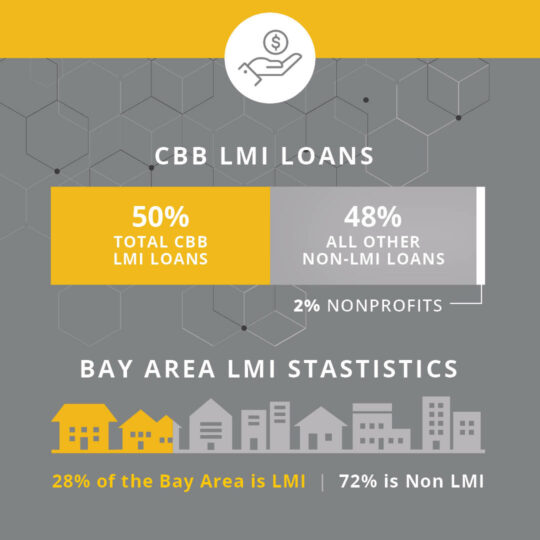

Loans in Low or Moderate Income Areas: Only 28% of the San Francisco Bay Area is considered low or moderate-income, yet more than half of the loans given by CBB in 2021 were to businesses in low-to-moderate income areas. We continue to prioritize helping the local businesses and neighborhoods that need it the most.

Client Spotlight

Byrd's Filling Station

Paving the Way Toward a Zero-Waste Future

“We appreciate CBB’s values around not only investing locally and investing in small businesses, but also putting that investment towards businesses that are green… or are doing things in such a way that they are contributing to the community—both environmentally and socially.”

— LAURA PORTER, OWNER, BYRD’S FILLING STATION

CDFI certifications are issued by the U.S. Department of the Treasury to recognize institutions that serve economically distressed communities. Local community development is written into CBB’s institutional DNA.

-

In 2018, we signed the Anti-Displacement Code of Conduct because stopping housing displacement aligns with our mission as a values-based bank. In fact, we are the first and only bank in California to commit in this way. We place the needs of our entire community in our decision and loan-making processes and align with the California Reinvestment Coalition to stem the tide of displacement for communities in our backyard.

-

Our clients are a unique makeup of individuals, businesses, and nonprofit organizations, all rooted in the Bay Area. Our commitment is to serve the “real economy” and enable local businesses and communities to thrive. The real economy is the financial activities that directly support the production and selling of physical goods and services. We don’t invest in hedge funds, cryptocurrency, or other risky financial activities.

-

Only 38% of the San Francisco Bay Area is considered low- or moderate-income, yet more than half of the loans given by CBB in 2022 were given to businesses in low-to-moderate income areas. We continue to prioritize helping the local businesses and neighborhoods that need it the most.

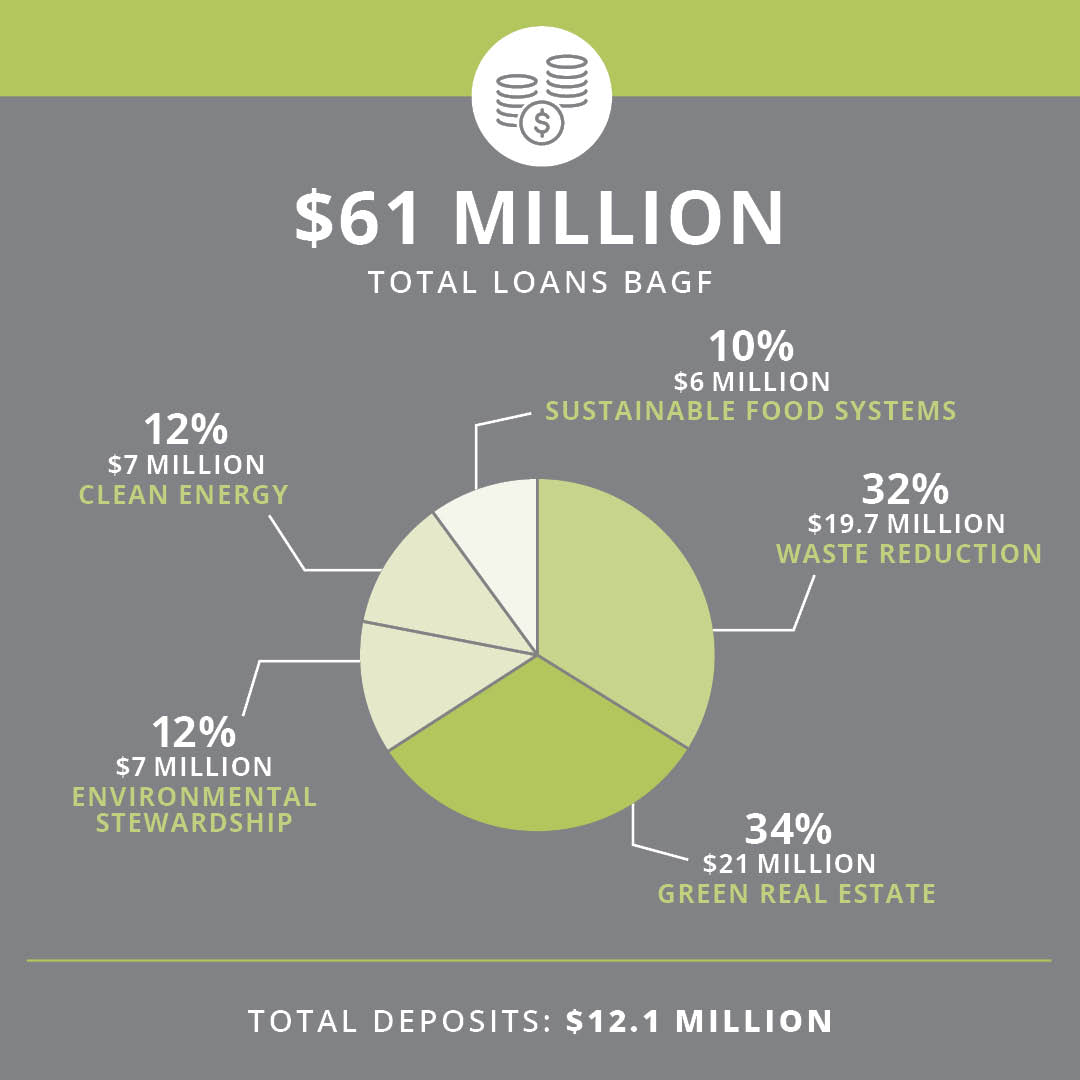

Bay Area Green Fund: Green Banking For A Better Future

Bay Area Green Fund: Green Banking For A Better Future

Since the Bay Area Green Fund was created in 2006, we have offered environmentally-friendly banking solutions to support individuals, local businesses, and the environment. Unlike many big banks, the Bay Area Green Fund doesn’t give loans to fossil-fuel projects. We invest in “green” projects in one of five environmental categories.

- Waste Reduction

- Clean Energy

- Green Real Estate

- Environmental Stewardship

- Sustainable Food Systems

Learn More About Our Impact

Why Bank with a CDFI?

As a CDFI, we expand economic opportunities in underserved areas, while making a broad spectrum of community contributions.

Our Community Roots

Our roots run deep, Learn about CBB’s history and meet our dedicated, community-minded team.