2020 4th Quarter Earnings

Bay Community Bancorp Fourth Quarter Earnings Increase 49% to a Record $1.58 Million; Full Year 2020 Earnings Increase 20% to a Record $4.89 Million

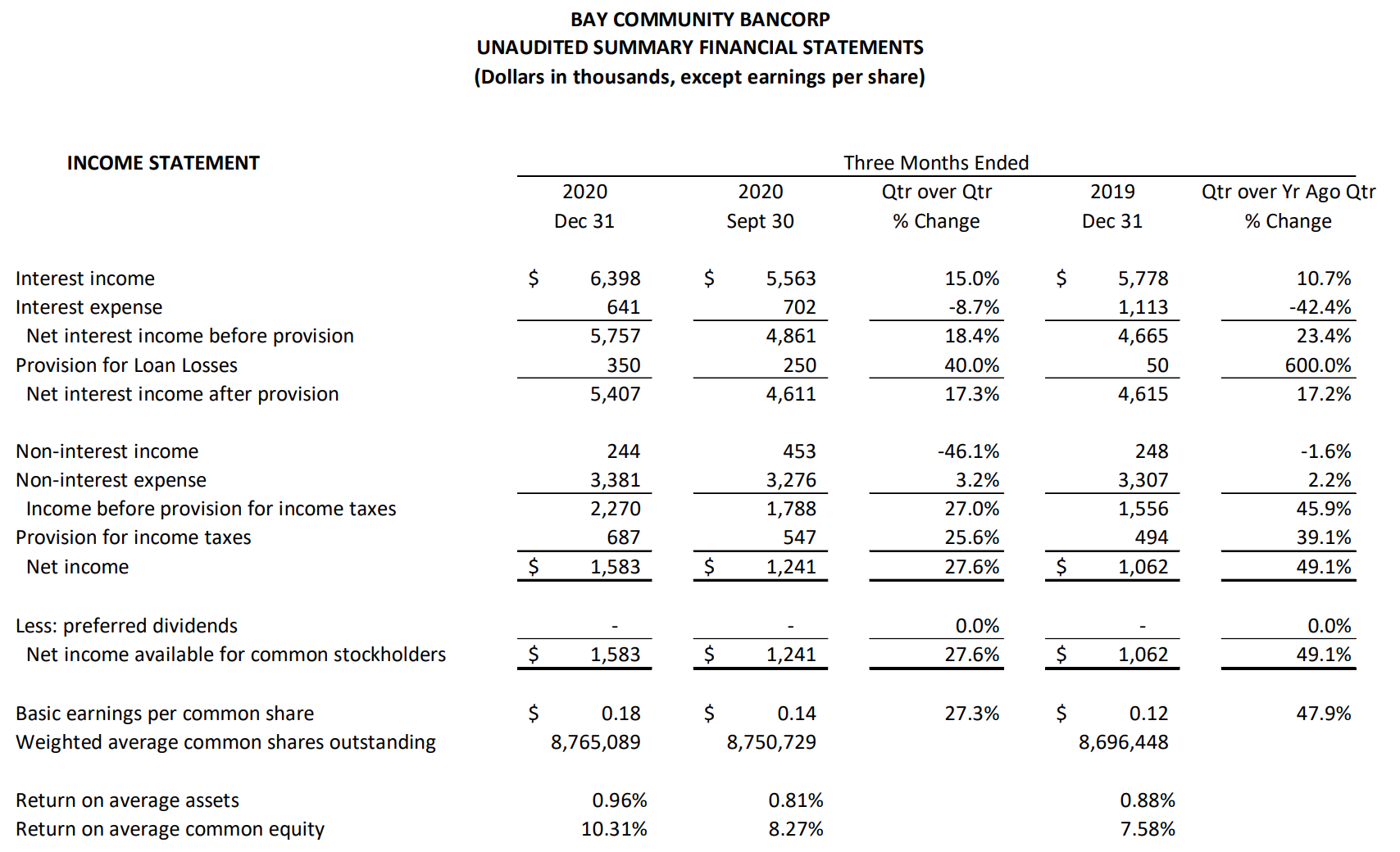

OAKLAND, CA – January 29, 2021 — Bay Community Bancorp, (OTCPink: CBOBA) (the “Company”), parent company of Community Bank of the Bay, (the “Bank”) a San Francisco Bay Area commercial bank with fullservice offices in Oakland, Danville and San Mateo, today reported record net income for both the fourth quarter and the full year ended December 31, 2020. Earnings increased 49.1% to $1.58 million for the fourth quarter of 2020, compared to $1.06 million for the fourth quarter of 2019. For the year 2020, net income increased 20.1% to a record $4.89 million, compared to $4.07 million in 2019. All financial results are unaudited.

“We produced record results for the quarter and for the year, with higher net interest income, double digit loan and deposit growth and most importantly, stable credit quality,” stated William S. Keller, President and CEO. “Despite the pandemic-related economic challenges creating a difficult operating environment, we delivered excellent results, as we continued to support our customers, communities and employees.”

“In December, we formed Bay Community Bancorp, a bank holding company that is now the parent company of Community Bank of the Bay,” Keller continued. “This holding company structure will provide us with more capital flexibility to support our growing San Francisco Bay Area franchise, in addition to providing additional revenue generating opportunities.” The financial data presented in this release is now consolidated, which only affected fourth quarter 2020 results. The results for the fourth quarter of 2020 are comparable to prior Bank-only quarters.

“One of the highlights of the year was the support the Bank provided to its clients through the SBA’s Paycheck Protection Program (PPP),” said Keller. “Our team did an excellent job of helping our clients, as well as many new potential customers navigate the program. During the second and third quarters of 2020, we helped 395 customers receive $81.2 million in PPP funding, with approximately one-third of the loans going to potential new clients. Many of these new PPP borrowers have already transitioned into full client relationships. The first round of PPP expired on August 8, 2020 and, as of year-end, we had received payments from the SBA for forgiveness of $15.2 million for 68 of our PPP borrowers. Approximately $527,000 of the fee income recognized during the fourth quarter related to these loan payoffs.”

“Additionally, we are actively participating in the SBA’s new round of PPP funding that began earlier this month,” said Keller. “This additional round of SBA funding provides PPP loans for companies that did not receive a PPP loan in 2020, and also “second draw” loans targeted at the first-round borrowers who were most effected by the pandemic. As a certified Community Development Financial Institution, our Bank is actively supporting the SBA’s efforts to assure that all qualified applicants have access to this valuable economic recovery program. Prior to launch we conducted broad outreach and educational efforts to reach as many small businesses as possible, and began processing applications on January 11, one week before non-CDFI banks. Ten days later we funded our first PPP loans and as of January 27, we have obtained SBA approval for 203 loans totaling $36.5 million dollars for our customers.”

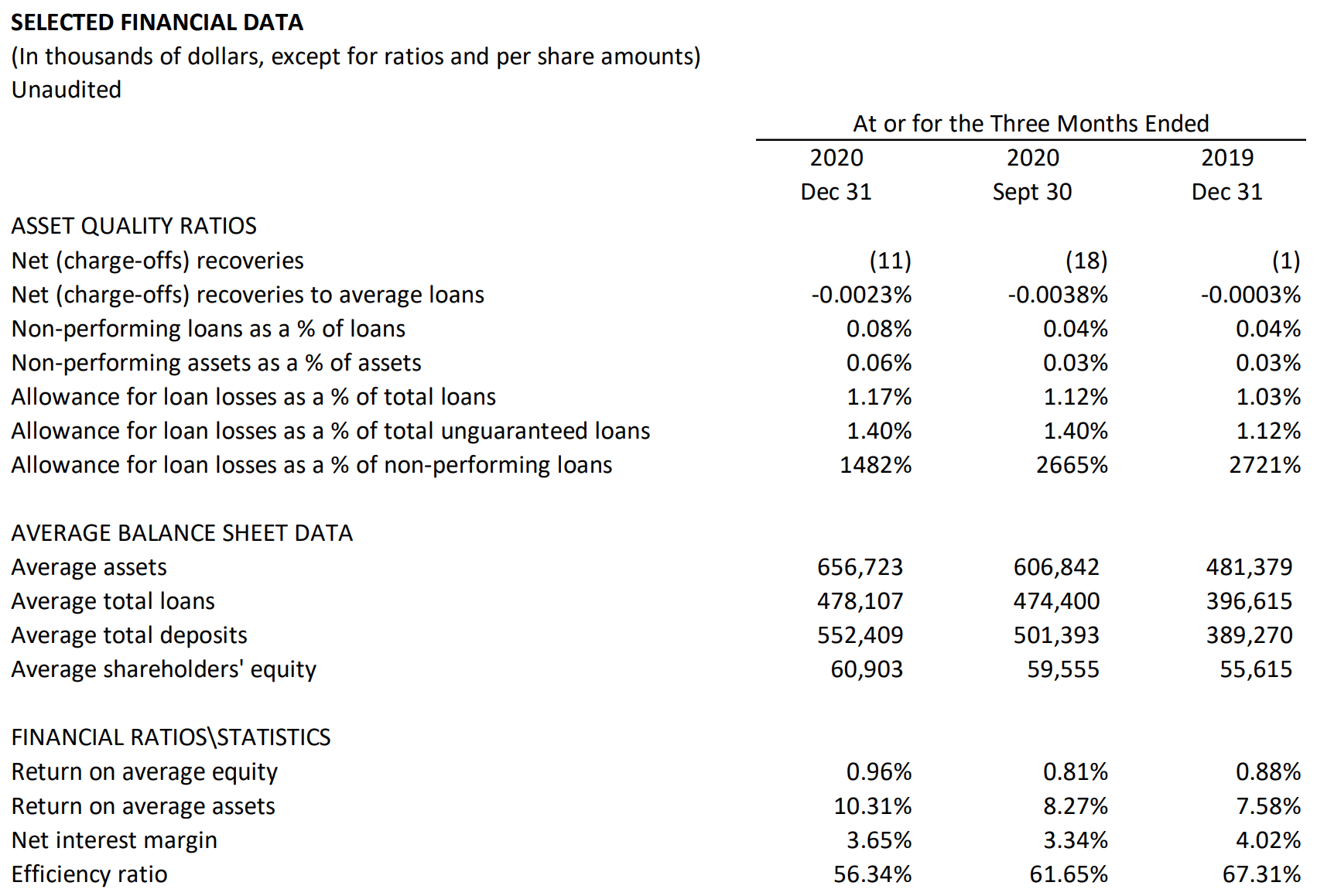

“The positive impact relating to PPP loan forgiveness contributed to a 38-basis point increase in net interest margin during the fourth quarter compared to the prior quarter, and helped keep our net interest margin above industry Bay Community Bancorp Reports Fourth Quarter 2020 Financial Results January 29, 2021 Page 2 averages,” added Keller. The Company’s net interest margin was 3.65% in the fourth quarter of 2020, compared to 3.34% in the preceding quarter, and 4.02% in the fourth quarter a year ago. The net interest margin remains higher than the peer average of 3.29% posted by the 440 banks that comprised the SNL Microcap U.S. Bank Index as of September 30, 2020.

“Despite sound credit quality metrics, and extremely low levels of net charge-offs, we booked a $350,000 loan loss provision in the fourth quarter of 2020 in recognition of non-PPP loan growth,” said Mukhtar Ali, Chief Credit Officer. “During the year we provisioned $1.60 million and our loan loss reserves now represent 1.40% of total non-guaranteed loans at year end, compared to 1.12% a year earlier. We continue to review our loan portfolio and communicate with our borrowers and we believe that we have adequate provisions in place to navigate through this pandemic. Our portfolio exposure to the industries most affected by the pandemic decreased by $10 million in the quarter as two hospitality loans paid off, and the rest are almost entirely secured by real estate, with conservative loan-to-value ratios, and strong guarantors who we have worked with us for years and through several credit cycles.”

The Bank’s exposure to the industry segments generally considered most at risk from the effects of the pandemic as of December 31, 2020 consists of:

“We also offered loan accommodation options to support our clients who had been affected by the economic impacts from the pandemic. As of December 31, 2020, loans totaling $14.0 million, or approximately 2.87% of the nonPPP loans, remain on deferral, all of which are scheduled to resume full payment terms during the first quarter,” added Ali.

Fourth Quarter 2020 Financial Highlights (at or for the period ended December 31, 2020)

- Net income increased 49.1% to $1.58 million in the fourth quarter of 2020, compared to $1.06 million in the fourth quarter a year ago. Earnings per share was $0.18 in the fourth quarter of 2020, compared to $0.12 in the fourth quarter a year ago.

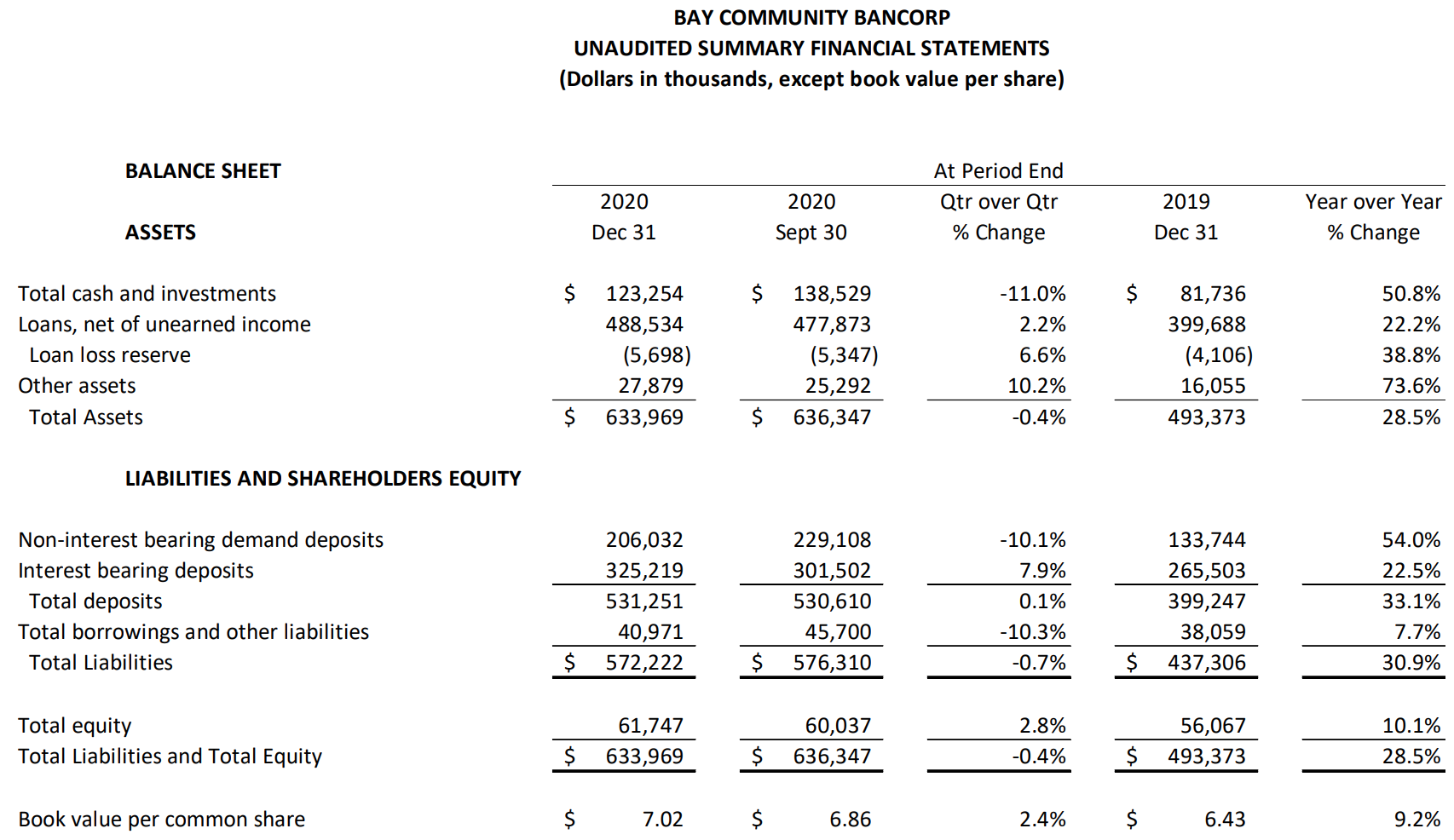

- Total assets increased $140.6 million, or 28.5%, to $634.0 million at December 31, 2020, compared to $493.4 million a year earlier, and decreased modestly compared to $636.3 million three months earlier. Average earning assets for the quarter totaled $625.0 million, an increase of $164.3 million, or 35.7%, from the fourth quarter a year ago and an increase of $46.4 million, or 8.0%, compared with the prior quarter end.

- Pre-tax core earnings excluding gains on loan sales, PPP loan fees and loan loss provisions, was up $453,000 or 28.2% to $2.06 million in the fourth quarter compared to the fourth quarter a year ago.

- Net interest income, before the provision for loan losses, increased 23.4% to $5.76 million in the fourth quarter of 2020, compared to $4.67 million in the fourth quarter a year ago. Operating net income increased $714,000 in the fourth quarter of 2020 compared to the fourth quarter a year ago, due to a $1.09 million increase in net Industry Segments ($ in thousands) Balances % of Total Balances Loan Modifications Hospitality 34,005 $ 7.0% $ – Gasoline Stations 15,711 3.2% – Food Service 14,189 2.9% 2,451 Entertainment and Recreation 14,127 2.9% 8,414 Retail, Excluding Grocers and Gasoline Stations 4,443 0.9% – Total 82,475 $ 16.9% $ 10,865 Bay Community Bancorp Reports Fourth Quarter 2020 Financial Results January 29, 2021 Page 3 interest income, which was partly offset by a $4,000 decrease in non-interest income, a $10,000 decrease in non-interest expense and a $300,000 increase in the provision for loan loss reserve.

- Net interest margin for the fourth quarter expanded 38 basis points to 3.65%, compared to 3.34% in the preceding quarter. The net interest margin was 4.02% in the fourth quarter a year ago. The net interest margin expansion compared to the prior quarter was primarily due to accelerated accretion from PPP loan forgiveness, which added 38 basis points to the net interest margin for the fourth quarter of 2020. The average interest yield on non-PPP loans in the fourth quarter was 5.05%, a decrease/increase of 9 basis points from the prior quarter. The average Cost of Funds in the fourth quarter was 0.43%, a decline of 8 basis points compared to the prior quarter.

- Net loans increased $88.8 million, or 22.2%, to $488.5 million at December 31, 2020, compared to $399.7 million a year ago. The increase in net loans compared to the prior year primarily reflects the origination of SBA PPP loans during the second and third quarters of 2020, and totaled $65.2 million outstanding as of December 31, 2020, offset by an $11.9 million decline in acquired loans due to sales and accelerated prepayments. Net non-PPP loans grew $25.8 million, or 6.5% to $422.5 million for the three months ending December 31, 2020, compared to $396.7 million for the three months ending September 30, 2020.

- Total deposits increased $132.0 million, or 33.1%, to $531.3 million at December 31, 2020, compared to $399.2 million a year ago and increased nominally compared to $530.6 million three months earlier. The increase in total deposits from a year ago was partially attributable to SBA PPP loan funds deposited into customer accounts at origination. Noninterest bearing demand deposit accounts increased 54.0% compared to a year ago and represented 38.8% of total deposits. Savings, NOW and money market accounts increased 13.7% compared to a year ago and represented 39.6% of total deposits. CDs increased 42.5% when compared to a year ago and comprised 21.7% of the total deposit portfolio, at December 31, 2020.

- Asset quality remained strong with $384,000 of nonperforming loans at December 31, 2020, representing 0.08% of total loans. This compares to nonperforming loans at 0.04% of total loans at both December 31, 2019, and September 30, 2020.

- The allowance for loan losses totaled $5.70 million, or 1.17% of total loans at December 31, 2020, compared to $4.11 million, or 1.03% of total loans at December 31, 2019. The allowance, as a percentage of nonguaranteed loans, was 1.40% at December 31, 2020, compared to 1.12% a year ago. The allowance for loan losses now stands at 1,331% of non-performing loans and reflects management’s assessment of the current economic environment.

- Total equity increased 10.1% to $61.7 million as of December 31, 2020, compared to a year ago. The Bank’s capital levels remained well above FDIC “Well Capitalized” standards as of December 31, 2020, with a Tier 1 Common Equity capital ratio of 13.15%; Total risk-based capital ratio of 14.40%; and Tier 1 leverage ratio of 9.31%.

- Book value per common share totaled $7.02 as of December 31, 2020, an increase of 9.2% from a year ago.

About Bay Community Bancorp

Bay Community Bancorp (OTCPink: CBOBA) is the parent company of Community Bank of the Bay, a San Francisco Bay Area commercial bank with full-service offices in Oakland, Danville and San Mateo. Community Bank of the Bay serves the financial needs of closely held businesses and professional service firms, as well as their owneroperators and non-profit organizations throughout the San Francisco Bay Area. Community Bank of the Bay is a member of the FDIC, an SBA Preferred Lender, and a CDARS depository institution, headquartered in Oakland, with full-service branches in Danville and San Mateo. It is also California’s first FDIC-insured certified Community Development Financial Institution and one of only three operating in the Bay Area. The bank is recognized for establishing the Bay Area Green Fund to provide financing to sustainable businesses and projects and supports environmentally responsible values. Additional information on the bank is available online at www.BankCBB.com.

Forward-Looking Statements

This release may contain forward-looking statements, such as, among others, statements about plans, expectations and goals concerning growth and improvement. Forward-looking statements are subject to risks and uncertainties. Such risks and uncertainties may include but are not necessarily limited to fluctuations in interest rates, inflation, government regulations and general economic conditions, including the real estate market in California and other factors beyond the Bank’s control. Such risks and uncertainties could cause results for subsequent interim periods or for the entire year to differ materially from those indicated. Readers should not place undue reliance on the forwardlooking statements, which reflect management’s view only as of the date hereof. The Bank does not undertake, and specifically disclaims, any obligation to update or revise any forward-looking statements, whether to reflect new information, future events, or otherwise, except as required by law.

FINANCIAL TABLES TO FOLLOW: